|

he subjects of energy transition and reducing carbon emissions are on everyone's minds, and power electronics engineers' attention is focused on power solutions for electric vehicles, renewable energy, and the use of the latest technologies such as Wide Band Gap semiconductors. There is no doubt that we are at a turning point in the power electronics industry and lots of things are happening collaterally with the conversion from fossil fuels to renewable energy but there are a lot of other interesting areas to explore. I recently attended a workshop with a group of students and Business Angels and we brainstormed something they named the "Hidden face of the power industry." The purpose of this workshop was to analyze changes in the composition of the power supplies market regarding standard products and non-standard ones over the last two decades, and what might change in the next decade. It's not possible to cover everything in a short article but let's take a look at the main trends.

he subjects of energy transition and reducing carbon emissions are on everyone's minds, and power electronics engineers' attention is focused on power solutions for electric vehicles, renewable energy, and the use of the latest technologies such as Wide Band Gap semiconductors. There is no doubt that we are at a turning point in the power electronics industry and lots of things are happening collaterally with the conversion from fossil fuels to renewable energy but there are a lot of other interesting areas to explore. I recently attended a workshop with a group of students and Business Angels and we brainstormed something they named the "Hidden face of the power industry." The purpose of this workshop was to analyze changes in the composition of the power supplies market regarding standard products and non-standard ones over the last two decades, and what might change in the next decade. It's not possible to cover everything in a short article but let's take a look at the main trends.

The Shift!

Power supplies are used everywhere, and from a USB charger to the power solution powering the NASA James Webb telescope, the range of products and solutions are amazingly wide. The overall market for switching power supplies (AC/DC and DC/DC) in 2023 is estimated to represent a business of 58 billion USD and is composed of Merchant products (45B) also known as Commercial off-the-shelf (COTS), and Captive products (13B) developed by OEMs for their own internal use. As for any industry it is complex and difficult to be aware of everything and we rely on market studies from Market Analysts such as Micro-Tech Consultants or Wired & Wireless Technologies (WAWT) publishing detailed reports on market segmentation and forecasts, but in parallel with those studies it is interesting to granulate a bit to analyze the Hidden Face of the power industry. For more than 100 years the power electronics industry has been extremely dynamic and innovative, many times crossing the chasm of new technologies. As I presented in a White Paper (WP022): '1980 – a pivotal point in the power industry!' amongst all of them, the technology shift from linear to switching has not only been a very important one, but also the birth of mass COTS power supplies. Many power supply companies and OEMs started to deliver or implement volume products in the eighties e.g., Delta Electronics shipping in volume in 1983, telecom manufacturers AT&T commercially launching the 5ESS Switch with a new power architecture developed by Bell Labs Power Systems in 1982, Ericsson developing advanced distributed power architecture based on single bus voltage and modules and RIFA Power (Ericsson Power Modules) introducing its 25W PKA DC/DC converter line in 1983, whilst in Japan COSEL began shipping in volume its switching power supplies introduced in 1977, and that's without mentioning Patrizio Vinciarelli who founded VICOR in 1981. The eighties saw not only a technology shift, but a fundamental change in the way power supplies were designed, manufactured and sold to customers. It also marked a time when captive, representing more than 70% of the market, slowly migrated to merchant.

For those not born when Dinosaurs were still talking, we should remember that in the eighties the vast majority of the power supplies where manufactured in house e.g., PHILIPS, ALCATEL, AT&T, ERICSSON, THOMSON. As the merchant offering grew and the requirement for OEMs to invest in their core business came about, gradually power departments have been divested, becoming part of the merchant market.

Considering the shift from captive to merchant and the vast offering from low power DC/DC converters to high power AC/DC we could question what is the reasoning behind 'The hidden Face' of the power industry? What is missing in power supply manufacturers offering motivating interest for something else?

When standard is not enough!

Because power electronics is everywhere, there are a number of instances where buying a COTS product is not enough for systems architects when developing their applications. For different reasons they may need something very specific or so unique that OEM power supply manufacturers may not consider them viable enough, or outside their business strategy, to engage in research and development. Before we dig into details it is important to mention that OEM power supply manufacturers have always offered 'modified standards' when customers require small modifications in line with their process or requiring a small investment. This brings us to a short explanation of the different segments of the non-standard products and an explanation of the changes we saw in our study between 2000 and 2023 (Figure 01).

Figure 01 – 2000 – 2023 addressable market repartition and development (Source: PRBX/PLF)

|

Modified Standard

When designing COTS power supplies, manufacturers are taking into consideration final segments and applications, but customers might need small deviations. Modifications could be as simple as special trimming or something more complex requiring a mechanical modification, special cabling or additional codes in firmware. In 2000 the number of modified standard units sold represented 6% of the overall volume. This number decreased to 4% in 2023. One of the possible reasons is the modernization of the product offering during the period, and the addition of new functionalities such as a digital interface making it easier for the user to profile the product to more accurately meet their needs. Also, the impressive amount of new products released by power supply manufacturers covers a larger range of applications and accordingly we see some overlap between this category and semi-custom.

Semi-custom

There are probably as many definitions of semi-custom power solutions as manufacturers, but what is interesting is this category has grown significantly from 3% in 2000 to reach 7% in 2023.

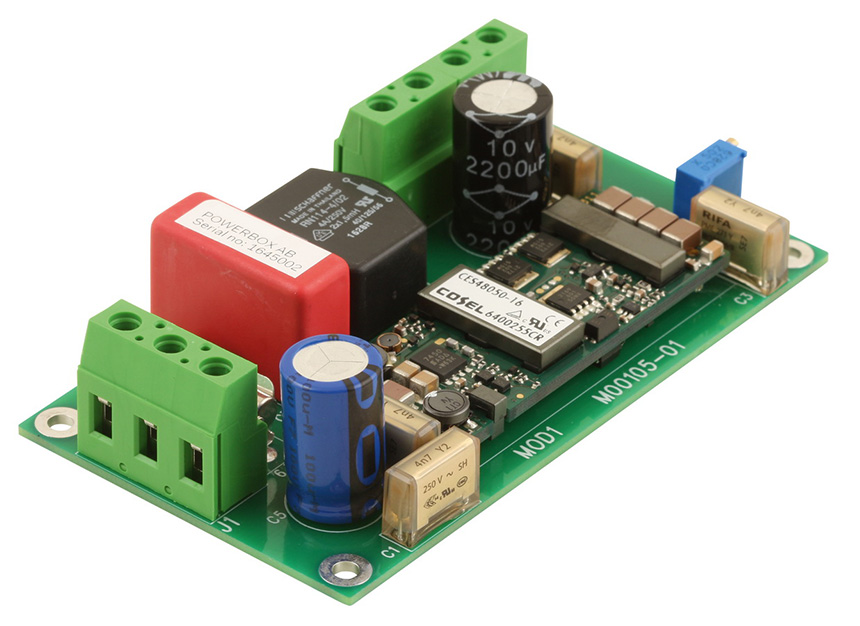

Figure 02 – Example of 1990 original concept for a

semi-custom power solution (Source PRBX/PLF)

|

|

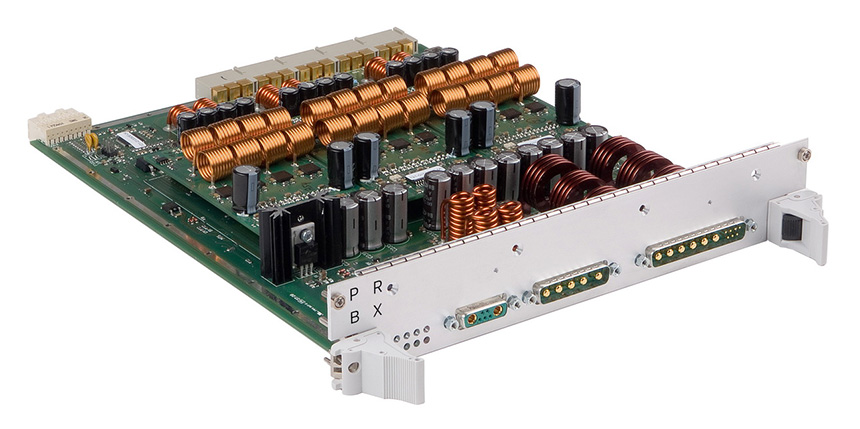

Figure 03 – Example of a product transition from semi-custom platform

becoming part of a standard COTS offering (source PRBX/COSEL)

|

As one of those remembering Dinosaurs talking, the first semi-custom that I remember designing was in 1986, developing an assemblage of a PWM power module on a PCB complete with connectors, embedded filters, potentiometer and indicator light (similar to as shown on figure 02) to replace a linear power supply within an industrial equipment. Something interesting to notice is that such a combination and building practice was later adopted by the industry, releasing a standard version of what used to be a semi-custom unit (Figure 03).

Figure 03 – Example of a product transition from semi-custom platform becoming part of a standard COTS offering (source PRBX/COSEL)

|

|

Figure 04 – Example of a semi-custom power solution combining a modules and additional components for filtering, protection, voltage trimming and connectors (Source PRBX)

|

As the offering of a combination of highly efficient power modules to build a final solution has been the heart of the semi-custom segment (Figure 04), within the power electronics industry the business model developed by VICOR and a network of Value Added Retailers contributed to the development of semi-custom solutions cannibalizing a part of what used to be full-custom. When analyzing this segment we found a small migration from modified-standard to semi-custom, and a significant migration from full-custom, for medium complexity power solutions.

Figure 05 – Full-custom is a very interesting area, where the product

development requires multidisciplinary cooperation (Source PRBX)

|

Full-custom

For power designers, full-custom is a very interesting area, where the product development requires multidisciplinary cooperation (Figure 05). It is not only about designing the best power stage but realizing a complete solution that could be extremely complex. This segment declined from 22% in 2000 to 15% in 2023, but nonetheless remains strong and stable. As we supposed, a portion of what used to be full-custom has been captured by the semi-custom area but the dividing line between the two segments is not as sharp as it looks on the graph. In fact there is a smooth edge between the two, with full-custom integrating modules, and semi-custom implementing a number of technologies deployed by the full custom industry – cross pollination. In this segment it is very often the case that power designers have to explore domains outside conventional power electronics, and to close this article I would like illustrate this by a coreless power supply designed to power a Magnetic resonance imaging scanner (MRI). In this case the power designers had to not only consider power conversion, but the specific environment with a switching frequency that didn't interfere with the MRI signal, and other problems (Figure 06). This might seem an exotic application but designing such a type of product is exactly what you cannot find in a COTS catalogue.

Figure 06 – Example of a full-custom power

solution for MRI equipment (Source PRBX)

|

The Exclusive

When doing research on the Hidden Face of the power supplies industry we discovered a niche that got named, 'Exclusive'! This is where you design a power solution for the extreme of extreme applications. We're talking products that are used in deep space exploration, in very high radiation and temperature environments, in nuclear reactors, and others. This is also an area where a design might require components that are not yet in existence. We estimated this segment at 1% but it is more an aggregation of power solutions rather than products as such. What is the future of the Hidden Face of the power industry?

We will probably address this in more detail in a future article, but considering the European regulation to prolong the lifetime of products, we believe it will be a significant number of systems that will require refurbishment, upgrading and modernization. Many of those products will require a combination from standard to full-custom. As we learned from the smooth dividing line between semi and full-custom we foresee those segments remaining solid and stable. When talking about modernization, we see a great opportunity for Wide Band Gap semiconductors contributing to make it possible to package more power into the same volume. In conclusion, the Hidden Face of the power industry is bright and it's an amazing experience for power designers to break limits.

References:

POWERBOX (PRBX):

https://www.prbx.com/ POWERBOX (PRBX) White Papers Library

https://www.prbx.com/literature/white-papers/ COSEL

https://en.cosel.co.jp/ Micro-Tech Consultants (Global Switching Power Supply Report)

https://mtcpower.com/ Wired & Wireless Technologies (WAWT)

https://www.wawt.tech/ For more information

Visit www.prbx.com

Please contact Patrick Le Fèvre, Chief Marketing and Communications Officer

+46 (0)158 703 00 Reference: PRBX-A-041-EN About the author:

Chief Marketing and Communications Officer for Powerbox, Patrick Le Fèvre is an experienced, senior marketer and degree-qualified engineer with a 40-year track record of success in power electronics. He has pioneered the marketing of new technologies such as digital power and technical initiatives to reduce energy consumption. Le Fèvre has written and presented numerous white papers and articles at the world's leading international power electronics conferences. These have been published over 450 times in media throughout the world. He is also involved in several environmental forums, sharing his expertise and knowledge of clean energy.

Provided by Patrick Le Fèvre

Powerbox Chief Marketing and Communications Officer | |  |

|